What Are 1 Hour Payday Loans?

When you’re facing an emergency like your car has broken down or there’s a medical bill that you need to pay, you might consider taking out a payday loan.

Even though there are a lot of online lenders advertising 1-hour payday loans, the “1-hour” part usually means something different than you might think at first. When you apply for a 1-hour payday loan, you can often expect that your loan application will be approved in under 1 hour; however, the funds you requested will be deposited to your bank account a bit later.

The exact time you will see the loan amount you requested in your checking account will depend on different factors, like when you apply, the lender’s internal processes, the banks’ operating hours, etc.

With One Hour Payday Loans, When Can I Expect To Get The Money?

When you apply with an online lender, even one that claims to offer one hour online payday loans, this doesn’t mean you will get your money in under an hour. Most of the time you will get your money the next business day. In some cases, if the lender provides a same-day deposit and you’ve managed to get your loan application approved before the cut-off time, you will get your cash by the end of the same day.

At PaydaySeek, we work with 100+ direct lenders providing payday loans. If approved early, you may get your money by the end of the day.

Here’s a breakdown of when you can expect to get your money depending on when you apply:

- Monday through Friday: If your loan application is approved before 10:30 a.m. CT, you will generally receive your money by the end of the same day. If your application is approved after 10:30 a.m. CT, you will generally receive your money the next business day. For example, if your application is approved at 10 a.m. on a Wednesday, you will most likely see the funds in your bank account by Wednesday afternoon.

- Friday 10:30 a.m. CT through Monday 10:30 a.m. CT: If your loan application request is approved between 10:30 a.m. CT Friday and 10:30 a.m. CT Monday, you will receive your funds on Monday. If Monday happens to be a non-banking day, you will get your money the next business day.

Remember: The exact time of funding will depend on when your bank credits the ACH (Automated Clearing House) to your bank account. It could happen that the lender sends the ACH the same day you apply, but your bank credits the incoming ACH only the next business day.

Can I Get a 1 Hour Payday Loan With No Credit Check?

If the lender you apply with claims to provide 1 hour payday loans with no credit check, this usually means that, if eligible, your application may be approved in under one hour. As for the “no credit check” part, while some lenders may not run credit checks at all, most will perform a soft credit check on the borrower.

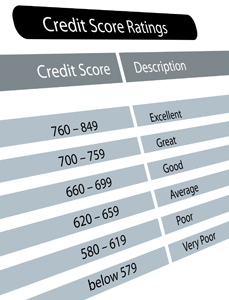

A soft credit check, also often referred to as a soft credit pull, will usually contain the applicant’s credit score, as well as some other basic information. Unlike hard credit checks, a soft credit inquiry will not affect your credit score or leave a record in your credit history with any of the BIG 3 credit bureaus like TransUnion, Equifax, or Experian.

However, there are other, smaller credit bureaus that may hold your credit history with payday loans, as well as installment and car title loans:

- Corelogic Teletrack

- Experian’s Clarity Services

- FactorTrust

- DataX

- MicroBilt

- and others.

Payday loan lenders may pull your credit history with those specialty credit bureaus and use it as part of their eligibility criteria. However, even if the lender does perform a soft credit check on you or pulls your entire credit history with Corelogic Teletrack or Experian’s Clarity Services, they almost never make credit decisions off of it alone. It’s your repayment ability that they rely upon most when determining whether to approve your loan request.

So instead of focusing on finding a loan lender providing no credit check payday loans, you’re better off applying with as many lenders as you can. This will help you increase your chances of getting a loan.

At PaydaySeek, we work with a hundred plus direct payday loan lenders. Neither us nor any of the lenders we work with will ever perform a hard credit check on you. Applying with us will not lower your FICO score either.

Getting 1 Hour Payday Loans From Direct Lenders. What Are The Pros and Cons?

When aiming to get one hour payday loans from direct lenders, you should consider a few things. First of all, most of the time you will get your money the next business day. In some cases, if approved early and the lender provides a same-day deposit, you will get the money by the end of the day you apply.

Secondly, you should understand that when you apply with a lender directly, it’s just this one lender. If denied, you will have to do your due diligence once again and apply with another lender. Depending on your credit history with payday loans, your income status, the number of days to your next payday, etc., it may take up to 5-7 attempts or even more before you can find a lender willing to work with you.

Alternatively, instead of looking for one-hour payday loans with no credit check from direct lenders, you could use a matching service. The application process looks the same:

- You fill in a quick online form.

- The matching service looks through a hundred available direct lenders that they work with.

- Once they find a lender, they redirect you to the lender’s website where you will find your loan agreement. The agreement includes the APR, repayment terms, and any other loan fees, if applicable.

- The lender may also contact you over the phone to verify your loan application. Normally, payday loans involve little paperwork and no faxing of documents whatsoever. However, in rare cases, they may ask you to email them a copy of proof of ID, and/or a recent paycheck stub (especially, if your main income comes from sources other than employment).

- If you’re okay with the terms outlined in the loan agreement, just e-sign it on the lender’s website.

Shortly after you e-sign the loan agreement, the lender will send an ACH transfer to your bank account.

So What Do I Do If I Need The Money Fast?

If you can wait until the next business day, consider applying with PaydaySeek. We work with a hundred plus direct payday lenders, which makes it possible for us to find you a loan lender even if you have bad credit.

If you can’t wait that long and need money in literally under one hour, consider applying in person at the nearest payday loan store. If approved, you will get your money instantly.