Get Instant Payday Loans With No Credit Check

Payday loans are short term cash advance loans that you can take out to cover unforeseen expenses like car repairs, unpaid medical or utility bills, and other short-term financial needs. They are very quick and easy to get, and if approached wisely, they can provide almost instant relief for people in an emergency.

There are a lot of payday lenders on the Internet who advertise instant loans on their websites. Although some of these lenders may provide loans in a timely manner, you should know exactly what the “instant” part means.

Does Getting an Instant Payday Loan Imply an Instant Deposit?

Once you’ve filled in the application form on the lender’s website or through us here at PaydaySeek, you will get an instant decision about whether you’re pre-approved. The payday lender may then contact you over the phone to validate your loan request. After that, you will need to e-sign the loan agreement on the lender’s website.

The entire application process from filling in the form to signing the loan agreement is usually swift and takes no more than an hour. However, the exact time when you get the loan amount you requested will depend on the lender’s internal processes and the time of day and the day of the week you apply.

Since it takes time for lenders to send the ACH deposit, and for banks to process incoming ACH credits, instant deposit payday loans don’t exist per se. However, some lenders do offer same-day deposit payday loans and that’s what you should strive to get instead.

Loan Applications on Weekdays

As a rule of thumb, try to apply early in the morning before the cut-off time to be eligible for a same-day deposit. The exact cut-off time varies between lenders but is usually around 10-11 a.m. If you want to get your instant decision payday loan the same day you apply, we suggest you apply somewhere around 8-9 a.m. to be on the safe side.

However, in some cases, you may still get your loan the next business day instead of the same day despite applying early:

- You applied early in the morning but the lender missed the cut-off time with your approval. For example, you might have applied at 7 a.m. to be on the safe side, the cut-off time being 11 a.m. But the lender only managed to approve your application by 11:30.

- You applied early and the lender approved your application before the cut-off time as well. The lender’s bank sent the ACH deposit in time, but your bank only managed to process the incoming ACH credit the next business day.

In either case, you will see your money in your bank account the next business day.

Loan Applications on Weekends, Holidays, and Other Non-Banking Days

When someone is looking for instant payday loans on a weekend, it usually means there’s an emergency. Even though some lenders do operate on weekends, most banks work according to their banking hours only. So if you’re looking for an instant payday loan and need cash fast, you’re better off applying at the nearest payday loan store in person.

If you can wait till the next business day, go ahead and apply today on our website, no matter whether it’s Saturday or Sunday. If the lender you’ve been matched with by PaydaySeek operates on weekends, they will approve your loan application on the weekend and you will see the money in your bank account on Monday. If Monday happens to be a non-banking day, you will get your cash the next business day.

Can I Get a Payday Loan Online With No Credit Check And Instant Approval?

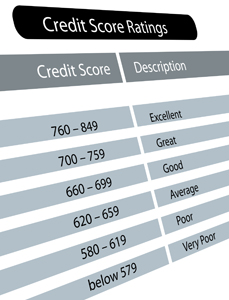

At PaydaySeek we work with a hundred plus carefully vetted instant loan lenders who provide instant approval payday loans. Some lenders do not rely on credit checks, while most will prefer to run a soft credit check on you, which may include getting your credit rating. Unlike hard credit checks, soft credit inquiries will neither affect your FICO score, nor show up on credit reports from credit bureaus like TransUnion, Equifax, or Experian.

Even though the lender will have your credit rating, they rarely rely on it when making credit decisions. There are other factors that they take into account when assessing your repayment ability, the main one being whether you have a steady stream of income.

Before you apply for an instant cash advance online, make sure you meet the following requirements:

- You reside in one of the states where online instant payday loans are legal

- You’re at least 18 years old (or 19 in Alabama and Nebraska)

- You have a regular source of income (the income can be from employment or from benefits including social security, disability, etc.)

- You have an active checking account (if you have a savings account, please go ahead and apply with us anyway. We might still be able to find a lender for you)

- You have a valid email address and phone number

If you meet the requirements above and are looking for instant decision cash loans, feel free to apply at the top of this page. You will get the loan decision instantly. If approved, we will redirect you to the lender’s website where you can finalize your loan agreement.

What Are The Pros And Cons Of Getting Instant Payday Loans From Direct Lenders?

If you’re looking to apply for payday loans online from direct lenders with instant approval, you have two options. You could go ahead and look up a direct lender online. Alternatively, you could use a matching service like PaydaySeek, who has access to more than a hundred carefully vetted legit loan lenders.

Getting Pay Day Loans From Lenders Directly

Advantages

- If you choose the direct lender route, you will know everything about the loan lender you’ve decided to go with. You will know their website and physical address, so you can contact them with any questions that you have in mind. You can find out whether people are talking about them on the Internet. In other words, you can find a lender with the most trustworthy website, an appealing offer, and the best reviews to make sure your loan application goes seamlessly.

Disadvantages

- No matter how reputable the lender you’ve chosen is, if you have a sub-par credit score and their lending decision algorithms are a bit strict, you might still end up rejected. You will need to find another lender, who may also reject your loan application. Depending on your credit score, it could take up to 6-7 attempts with different lenders before you finally get approved. In some cases, you may not be able to find a lender at all.

- When you’re looking for instant payday loans online, you will stumble upon different types of lenders. Some of them will be based offshore and others will be on tribal territories. They may offer more money and better repayment terms, but they can also come at higher fees and rates. They might ignore state laws too.

Getting Instant Payday Loans from PaydaySeek

The application process is the same: you fill in an online application form. If approved, we will redirect you to the lender’s website where you can review the terms and conditions of your loan agreement. If the terms are suitable, you can sign the agreement and wait for the money to come in.

Advantages

- Since we work with a hundred+ lenders, your chances of getting a loan with us are much higher than when applying to a lender directly. We will send your application information to each and every lender one by one until we find one willing to grant your loan request.

- All the instant payday loan direct lenders we work with are carefully vetted, legitimate lenders, who work within the full extent of the law and practice fair lending.

Disadvantages

- Once we’ve found you a lender, we will redirect you to the lender’s website where you can review and finalize your loan agreement. Only then will you know the name of the company that will service your loan. Please note: pre-approval does not oblige you to sign an agreement whatsoever. You can close the lender’s website and seek funding elsewhere.

In either case, whether you apply with a direct lender or via a matching service, at the end of the day the company who will service your loan will be a direct and legitimate lender. And in either case, you will know the loan terms and conditions, including the APR, only after you’ve been pre-approved but before you sign the agreement.

So if you’re looking for cash advance loans with instant approval and would like to increase your chances of being approved and spend as little time looking as possible, try requesting a loan via PaydaySeek.

Do You Provide Instant Payday Loans for Bad Credit?

Absolutely! Bad credit implies poor credit history with traditional credit agencies like TransUnion, Equifax, or Experian. The pay day loan lenders we work with don’t check your credit history through them.

Some lenders, though, might check your credit history concerning cash loans specifically. There are a few specialty credit reporting agencies like CoreLogic Teletrack and Clarity Services who focus on payday loans, installment loans, cash advances, and car title loans.

So if you have defaulted on a payday loan before, or have an outstanding loan in a state where it’s forbidden to have more than one loan at the same time, the lender might find out and this will prevent you from getting a new loan.

If you’re looking for instant online payday loans for people with bad credit, look no more. At PaydaySeek, we work with a hundred+ direct lenders, all of them having different underwriting requirements. So even if your credit score is less than perfect, we might still be able to find you a loan.

Where Do I Find The Best Online Payday Loans With Instant Approval?

If it’s a weekday and early morning, go ahead and apply with PaydaySeek here. If approved before the cut-off time, you may be eligible for same-day funding. Please discuss it with the lender we’ve matched you with.

If you’re looking for instant payday loans and need cash ASAP, preferably in under a few hours, you are better off applying in person at the nearest payday loan shop. If approved, you will get the cash immediately.