Getting No Fax Payday Loans

When you apply for payday loans, they are usually easy to get. Just fill in a short online application form and, if approved, you will get your money either the same or next business day. Most of the time, the lender will not require you to send any additional documents via fax or email.

However, in some situations, the lender might actually require you to send some documents. Back in the day, the lender would demand you use a fax machine to send the documents; however, in present times that’s extremely rare. Most of the time you will take a photo or a screenshot of the documents they want and send them over email.

So when you apply for a faxless payday loan, that doesn’t rule out the sending of additional documents. It just means that the lender won’t require you to use a fax machine to do so.

What Do I Need To Be Eligible For a Payday Loan With No Faxing?

When you apply for a no fax payday loan, the requirements are the following:

- You must be 18 years of age or older

- You must be a US citizen and reside in a state where payday loans are allowed

- You must have an active checking account

- You must have a steady income stream

- You must have a working email address and telephone number

Once the lender receives your application, they will try to verify your current residence, employment, and bank information. If they succeed, you will qualify for the faxless approval process. If they don’t, they might contact you at the phone number you provided and request some additional documents, including:

- Your most recent paycheck stub

- Your most recent bank statement

- Proof of the last loan clearing your account

- Proof of identity

Most of the time, a lender will require you to send additional documents if they are unable to verify your employment information, or if you get income from sources other than employment. For example:

- If you receive alimony

- If you receive disability or other social security benefits

- If you are self-employed

- If you reside in IL, NM, NV, or RI

However, most of the time there’s no additional paperwork required. Even if the lender requires you to send them anything, you can do so via email. So no faxing of documents whatsoever.

At PaydaySeek we work with 100+ direct lenders offering faxless payday loans. In the rare case that the lender we’ve matched you with does require you to send something, you can do so via email.

Where Do I Find No Fax Payday Loans From Direct Lenders?

If you’re looking for faxless payday loans from direct lenders specifically, you have two options where to find them.

Find a Direct Lender Online and Apply Directly

You can try to look for no fax payday loans online. There are a lot of direct lenders online who advertise payday loans with no faxing required whatsoever.

However, you should know that all lenders are very different and have different underwriting requirements. When you apply to the lender you’ve chosen, depending on your previous credit history, income, the number of days to your next payday, and other factors, you may not always be able to get the funds you need on the first try.

Just don’t give up if you’ve been rejected once or twice. It’s a numbers game. The more attempts you make, the more likely it is that you will eventually find a lender willing to approve your loan request.

Find a Direct Lender Using a Matching Service

Alternatively, you could use a matching service. A payday loan matching service is a company that has relationships with dozens, sometimes up to a hundred, direct lenders. When you apply with a matching service, they will send your loan application information to all the lenders they work with, one by one, until they find you a lender willing to work with you.

Basically, getting no faxing payday loans from a matching service is equal to manually applying to dozens of direct lenders yourself, but without spending hours of work on just filling in forms.

At PaydaySeek we work with more than a hundred carefully vetted legit payday loan lenders offering online payday loans with no faxing required. Fill in a short online application form and get connected with a direct lender almost instantly.

If I Have Bad Credit, Will PaydaySeek Find a Direct Lender For Me? Do You Perform Credit Checks?

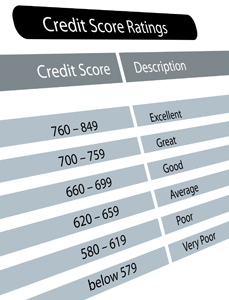

When borrowers mention their poor credit history, they are usually referring to their credit history with one of the national credit bureaus like TransUnion, Equifax, or Experian. Luckily, the majority of payday lenders don’t consider your previous history with those national credit agencies when making credit decisions, nor do they report payday loans to them.

However, there are other specialty credit agencies that may hold your credit history concerning payday loans specifically. The most widely used among payday lenders are CoreLogic Teletrack and Experian’s Clarity Services. So if you have a bad credit history with either of the two, this may have a negative impact on your ability to get a loan easily.

But then again, cash advance lenders rarely make lending decisions off of your credit history alone. It’s your repayment ability that matters most to them.

We work with 100+ direct lenders offering faxless payday loans for bad credit. So if you have a sub-par credit score, we may still be able to find a lender willing to approve your loan request.

If I Apply With PaydaySeek, Will You Run a Credit Check on Me?

Even though payday lenders often advertise faxless payday loans with no credit check, they will usually run a soft credit check on the applicant. The check usually includes the borrower’s credit score and other basic information.

Unlike hard credit pulls, soft credit inquiries don’t show up on the borrower’s credit history report or affect their FICO score.

Request a Loan From Us And Get an Instant Decision

When you apply for faxless payday loans, it’s important to know whether the lender you’re applying with follows state regulations and provides legit payday loan offers.

At PaydaySeek we go the extra mile to vet the lenders we work with. When requesting a loan with us, you can rest assured that the lender we match you with is a legit payday loan lender.

So if you’re looking for online faxless payday loans, just give us a try. If approved early in the day, you may be eligible for a same-day direct deposit. If not, you will get the loan amount you requested in your bank account as soon as the next business day.