Second Chance Payday Loans

Do you have an emergency bill that you need to pay but don’t have enough cash at the moment? You might have even tried to get a loan to cover your unforeseen expenses, but were denied? If so, applying for a 2nd chance payday loan might help.

What Are 2nd Chance Loans?

Second chance loans, sometimes also referred to as last chance payday loans, are short-term cash advance loans that you can get, even if you have bad credit and have already been denied for other types of loans a few times.

However, despite what the name might suggest, they are not guaranteed loans. If your credit history is downright poor, you might be better off looking for financing from friends and family, rather than from a financial institution. Or be prepared that you will need to request a loan from more than just a few lenders…

How Do I Get 2nd Chance Payday Loans From Direct Lenders?

If a lender is offering 2nd chance payday loans, this usually means that they care less about your past credit history and more about other factors when determining your repayment ability. Those factors, including how much weight each factor has, vary greatly between lenders.

In order to improve your chances of getting a payday loan, be prepared to apply to multiple lenders. Depending on your credit history, whether you’re currently employed, how much you requested, when your next payment is, etc., you may need to fill in from 2-3 to 7-10 online application forms with different payday loan lenders before you’re finally approved. In some cases, you might not be able to find a lender willing to grant your loan request at all.

Alternatively, try requesting a loan through a matching service. A matching service is a company that has direct relationships with dozens, sometimes hundreds of lenders at a time. Here’s how a matching service works:

- You fill in an online application form on their website. This is the exact same form you would find on a direct lender’s website.

- They will take your application information and send it to one of the direct lenders that they work with.

- If the lender rejects your loan request, they will automatically send your application information to another lender, and then another one, and another one, until they find a lender willing to work with you.

- When they find a lender for you, they will redirect you to that lender’s website, where you will find the proposed loan agreement. The agreement will stipulate all the terms and conditions pertinent to your loan. This will include the interest rates, when your loan is due, etc.

- If you agree to the terms of your loan, you e-sign the agreement.

- After that, the lender will send the funds you requested via direct-deposit directly to your checking account. Most of the time, you will get the loan amount you requested the next business day. In some cases, if approved early, you may be eligible for same-day funding.

At PaydaySeek, we work with 100+ direct lenders. This makes us capable of finding you a lender even if you have bad credit.

Do Second Chance Payday Loans For Bad Credit Exist?

When a person says that they have a bad credit history, they are usually referring to their credit history with one of the BIG 3: TransUnion, Equifax, or Experian. Most payday lenders don’t check your credit history with those national credit bureaus, nor do they report your payday loans to them.

However, there are other, less known credit agencies that hold your history with subprime loans specifically. That includes payday loans, installment loans, car title loans, etc. Here are a few of these bureaus:

- Experian’s Clarity Services

- Corelogic Teletrack

- FactorTrust

- DataX

- MicroBilt

- and others.

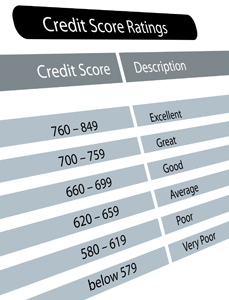

When you apply with a lender, they will also run a soft credit check on you, which means they will have your credit score as well.

As you can see, the lender will get a good understanding of your credit situation. They will either have your credit score based on the BIG 3 (TransUnion, Equifax, and Experian) or have your entire credit history with subprime lending specifically (most often Experian’s Clarity Services and Corelogic Teletrack). Or both.

Despite that, payday loan lenders rarely make loan decisions off of your credit history or credit score alone. So even if you have bad credit, don’t be afraid to apply for a loan. There might be a loan lender out there willing to work with you despite your bad credit.

Can Taking Out a Payday Loan Help Rebuild My Credit Or Improve My Credit Score?

As mentioned already, payday loan lenders don’t consider your credit with the BIG 3, like TransUnion, Equifax, or Experian, when making loan decisions, nor do they report payday loans to them. Therefore, taking out a payday loan will not help you rebuild your credit with any of the top-tier credit bureaus, nor will it improve your FICO score.

However, if for whatever reason your goal is to improve your credit history with Experian’s Clarity Services, Corelogic Teletrack, or any other credit agency focusing on subprime lending specifically, taking out and successfully repaying a payday loan would definitely help.

Request a Loan From PaydaySeek

At PaydaySeek we work with more than a hundred carefully vetted legitimate payday loan lenders, some of whom offer second chance payday loans to people with bad credit. Because we work with so many lenders, your chances of getting a cash advance loan with us are higher than when requesting a loan from lenders yourself.

Most of the time, we will need to send your application to 10-12 different lenders before we finally find a lender for you. This usually takes mere seconds. However, if your credit score is poor, it might require us to send your application to all the lenders we work with. In that case, finding a loan lender for you may take up to an hour.